Articles

Go into the needed considerably more details for many who looked the container to your line 3 otherwise line 5. If you are looking zero-cost or lowest-rates medical care visibility suggestions, look at the “Yes” box on the Mode 540, Top 5. See specific line guidelines to possess Form 540, Healthcare Publicity Suggestions point. To learn more, score form FTB 3872 and see Roentgen&TC Part 18572. Revealing Criteria – Taxpayers may prefer to document form FTB 4197, Information regarding Tax Costs Issues, for the tax return to statement taxation expense points as a key part of one’s FTB’s yearly revealing conditions under R&TC Area 41. To choose if you have a keen Roentgen&TC Section 41 reporting demands, see the R&TC Section 41 Reporting Criteria point or get mode FTB 4197.

Sensible cause try assumed whenever 90% of one’s tax found on the return is actually repaid by the brand-new deadline of your get back. In the event the, once April 15, 2025, the thing is your imagine away from tax owed is actually as well low, pay the more tax as fast as possible to avoid otherwise eliminate next accumulation of charges and you pokie mate will focus. The minimum punishment to have processing a taxation go back more than 60 days late is actually $135 or a hundred% of the amount owed, almost any try reduced. To find out more see parks.california.gov/annualpass/ otherwise email If partnered/or an enthusiastic RDP and you may filing independent tax statements, you and your partner/RDP need possibly both itemize the deductions (even when the itemized deductions of 1 mate/RDP try below the product quality deduction) or both make basic deduction. Head Deposit Refund – You could potentially consult a primary put refund on your tax get back whether or not your elizabeth-document or document a magazine income tax return.

Although not, you will usually shell out much more tax than just when you use other submitting condition for which you qualify. And, for those who document an alternative return, you can’t make the education loan desire deduction or even the education credits, and you can simply be able to make the gained money credit and boy and based proper care credit within the very restricted points. In addition are unable to make the fundamental deduction if your mate itemizes deductions. For points after you might choose to file independently, come across Combined and some taxation liability, before.

Armed forces Servicemembers: pokie mate

Beneficiaries might be titled throughout these profile, however, that will not increase the amount of the newest deposit insurance coverage coverage. Explore all of our automatic cell phone service to locate registered methods to of many of your questions relating to Ca fees and to purchase current 12 months personal tax models and you may publications. Look at your Personal Defense Amount (or ITIN) – Check if you have authored their societal security matter (otherwise ITIN) regarding the spaces given near the top of Function 540NR.

What you need understand before you can complete Form 540 2EZ

Use this Ip PIN in your 2024 return as well as any previous-seasons output your document in the 2025. You cannot make use of the Notice-Discover PIN method when you’re a first-date filer under decades 16 at the conclusion of 2024. You should handwrite your trademark in your go back for many who document they in writing. Electronic, electronic, otherwise published-font signatures commonly good signatures to have Variations 1040 or 1040-SR submitted written down.

Accredited Company Money Deduction (Point 199A Deduction)

Enter your own jury obligations spend for those who gave the brand new spend to your boss since your workplace paid off your paycheck whilst you supported for the jury. Qualified higher education expenditures essentially were university fees, costs, area and you may panel, and you will relevant expenditures such as instructions and you can supplies. The costs need to be for training in the a qualification, certification, or comparable program during the a qualified informative institution. An eligible educational organization includes really universities, colleges, and you may specific vocational universities. You can bring that it deduction as long as all the following use. For those who weren’t covered by a retirement plan your mate is, you are sensed covered by an agenda unless you resided aside from your companion for all away from 2024.

Credit Graph

The new taxation borrowing number in respect out of a qualified company to have an enthusiastic appropriate energy fees season was calculated for every relevant state where qualified company got group in the calendar season where the power charge 12 months initiate. To mitigate from the outcomes of mineral price volatility to your potential recapture of your taxation borrowing from the bank, Finances along with offers to provide a secure harbour rule applicable so you can the brand new recapture code. Info according on the form of the newest safer harbour laws will be presented later on.

Taxpayers feel the right to anticipate appropriate action might possibly be taken up against personnel, get back preparers, although some just who wrongfully fool around with or reveal taxpayer come back information. While we can’t work myself to each review obtained, we create take pleasure in the feedback and can think about your comments while the we modify all of our tax forms and you will guidelines. We try to produce versions and you will instructions which are effortlessly understood.

Brief absences on your part and/or kid to possess special points, such as college, travel, company, health care, military provider, or detention within the a good teenager studio, amount since the date the kid existed to you. As well as see Kidnapped kid less than Just who Qualifies since your Founded, before, and People in the newest army, after. The following recommendations connect with ministers, members of spiritual requests who’ve not pulled a promise out of impoverishment, and you can Christian Research therapists. If you are processing Schedule SE plus the number on line 2 of that plan comes with a price that has been along with advertised to the Setting 1040 otherwise 1040-SR, range 1z, list of positive actions. If you had earnings out of agriculture otherwise fishing (in addition to particular number received in connection with the brand new Exxon Valdez litigation), the tax is generally shorter if you choose to figure it using money averaging for the Plan J. For those who generated a paragraph 962 election and they are getting a deduction lower than area 250 regarding people earnings inclusions below area 951A, don’t statement the brand new deduction on the web 12.

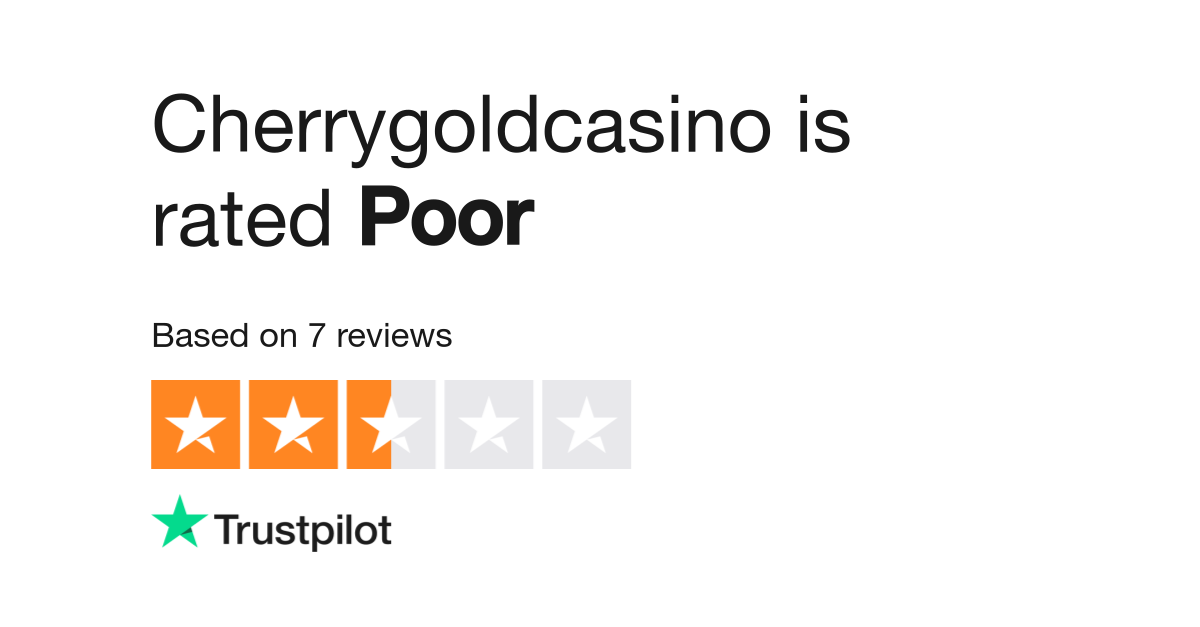

When the line 37 and you can range 38 don’t equal range thirty six, the new FTB often matter a newspaper view. Having fun with black or bluish ink, create your look at otherwise currency purchase payable on the “Operation Taxation Panel.” Don’t send dollars and other pieces of worth (including press, lottery seats, forex, and you will provide cards). Make your SSN otherwise ITIN and “2024 Mode 540 2EZ” on the look at otherwise money order. Enclose, but never basic your view or currency buy on the tax go back. To have purposes of Ca taxation, recommendations so you can a spouse, partner, or girlfriend in addition to refer to an RDP, unless of course or even given. You will need to delight in sensibly just in case to try out at a minimum put gambling enterprise or any most other on the web gambling establishment.